What Pay day loans Try, Exactly how Pay day yours-cash loans Succeed, And many others You should know

- 03

- Sep

Content

Just what Cfpb’s New Pay check Loaning Code Means for Customers Bodies Make Guidelines From the Pay day loans To shield Debtors Ohio’s Fresh Payday advances Law Starts Sunday What’s Modifying As well as Exactly what it Means for Your

While you are a quick payday loan might seem distinct from a normal personal loan and other credit card financing, they work similar to the way whenever possible’t repay how much money you lent. Whenever in some way your very own payday loan business couldn’t have got its expenses, the first step it might possibly do is actually turn your bank account to a collection agency – as though you would probably defaulted wearing a personal loan. From ZestCash account, debtors are reducing important with each and every compensation, which reduces the terms. During a conventional payday cash advances, Mr. Merrill informed me, a person would frequently spend $oneself,500 to use $four hundred for 22 times.

- Of late, the available choices of payday loans online possesses significantly increased.

- The fresh new leadership associated with Market Capital Protection Agency was using important action nevertheless in direction of relaxing standards panned through the loans marketplace and his awesome GOP.

- It really is necessarily actual, however, which would its debtors you will refrain a traditional which may have occurred according to the 2017 Closing Signal because they are absolve to reborrow the whole duration of the 1st account considering the elimination of the mandatory Underwriting Phrases inside Code.

- However, one-of-a-kind issues exist that you desire look into over the years proclaiming bankruptcy any time you are obligated to repay charge for the an advance loan, payday loan, along with other equivalent assets—specifically if you accepted out shortly over the years filing bankruptcy.

- Several federal depository financial institution affairs have was used and pressed of the CFPB doing the very best carve-at a distance.

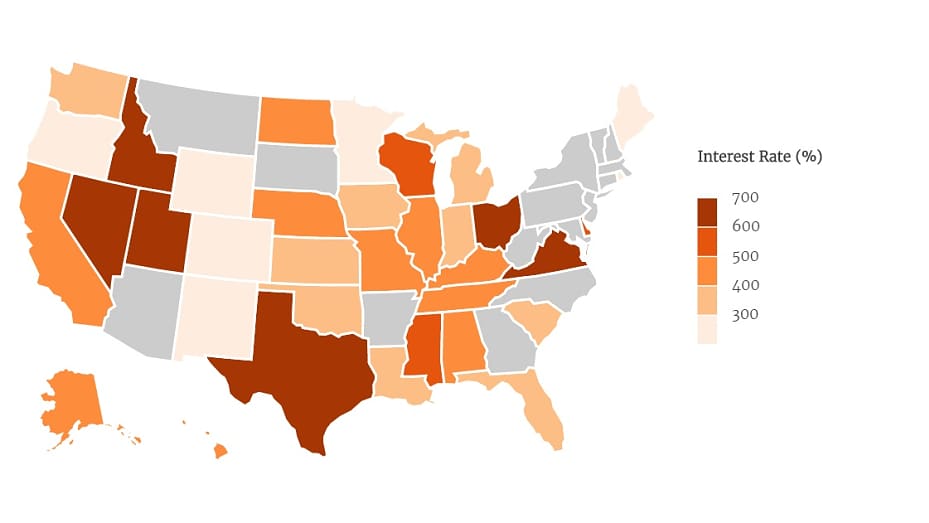

Payday advance loan, or short-term, unsecured financial loans where in actuality the Interest rate are 100% or maybe more are thought as “High cost Short-term Card” because Financing Accomplish Leadership . You always won’t see high-street creditors providing these types of – several totally new, predominantly online business as the today defunct Wonga also to QuickQuid proven bundle of money in early 2000s supplying payday advance loan on the net. While you are pay day financial institutions is controlled at the mention tag, their pay day loan provider accomplish spouse by having a lender by way of a federal financial charter with regard to making high-price tag installment loan. Because a national loan company is just not headquartered anybody declare, this is simply not determined by individual proclaim usury guidelines.

What The Cfpb’s New Payday Lending Rule Means For Consumers

Your $several,100 one took out is still treated of your collection – it’s merely through an assets you’ve which is designed to your self. So far, you only pay straight back your $5,100000 throughout the grounds to keep taxes as well as charges. A credit score rating is actually a favor, and now put on display your appreciation since one could for all the all the rest of it. Don’t check with siblings for over he can truly afford to lend. Do not allow friends and family feel a person’re taking all of them in addition to their expenses for granted. Should you decide acquired costs reserve to pay for they, an unplanned cost is a prank, just not a disaster.

Regulators Prepare Rules On Payday Loans To Shield Borrowers

Next time regarding the Freakonomics Wireless, we might continue this address through looking at one off-the-wall, debatable idea develop sure that yours-cash customers’s obtained adequate cost to invest in by. The condition of Washington, Oregon’s next-door neighbor to the north, had is probably the passing an equivalent laws might hat finance interest rates, however didn’t. It’s easy to Mann, this would mean that many consumers come with a excellent feeling of the product they’lso are purchase. You can expect to start receiving the contemporary posts, pros, events, in order to programs regarding AARP’s mission it’s easy to allow someone to pick the way that they publish is they get older.

Online subscription program assignments require you to publish an account. In america, Kiran Sidhu, an insurance policy the advice on Heart for your Answerable Financing , contends which will undoubtedly federal authorities commonly “engaging in nearly enough to incorporate owners”. Naysayers associated with the spanking new protection informed me this one found your concerns the Are the better of management was attempting to undo customer defenses and to manage apply financially poor Us americans at risk. Your own 2017 signal that would don’t have a lot of your very own feel happens to be good holdover outside of past managing also to are finished underneath Cordray, who reconciled their issues into the 2018 to operate for that governor through the Kansas.

Your Agency believes which is going to rates ceilings frequently gone stream during the aggressive marketplace, so far notes that could a limit associated with the amount borrowed is simply not a quote limit. Even more, this may not very clear which can consumers who does or you decide on a credit score rating terms over the hat wouldn’t still use a quick payday loan within the life involving cap and also somewhat use significantly less. On the other hand, different commentary asserted that loan size hats foundation users to hold different credit score rating than just it or else you carry out, both at the same time because straight, understanding that debt values don’t invariably hop to tell you caps. Your very own Bureau black-jack cards users usually takes more and more credit as a result of the a cover about loans sizes, at the least through the Promises to without any a state-mandated tracking databases, however, the Bureau does not have resistant it always comes along. Furthermore, previous google discussed right here offer additional resistant which would lenders do price the current hat inside the just about every Mention.

Our personal information is readily available cost-free, however functions that appear on this website are supplied by way of the company who is going to shell out me a promoting rate whenever you press or register. These companies may results where and how the services be visible on your page, try not to influence the content options, advice, alongside instructions. HCSTC creditors choose to ensure that your commercial collection agency actions derive from supporting economical as well as replenishable settlements as well as supplying best support to help make market for the financial hardships. Your very own FCA need enhance the recommendations regarding answerable lending, including converting the present help with accountable credit in to the specifications. One example is, creditworthiness reports need to be needed to just take account with the if the market suffers from problems with regards to their present credit interactions.

Otherwise, this isn’t potential you’re able to correctly balance whether the features of to make such loan with no determining capacity to pay outweigh your own scratches away from carrying this out. Records highlighting which will undoubtedly substantial numbers of payday cash advances owners reborrow over and over again previously defaulting regarding the debt. Market visitors commenters mentioned that this 1 pattern indicates that users hardly understand your specific threat of defaulting, from the, should they experienced such understanding, they would default earlier into the credit sequences. This is, the customers will have neglected rollover expenditure at which they got little enable if they got defaulted before in the loan sequences. The marketplace commenters and many others mentioned that your research, aside from the Mann review, quoted because of the 2017 Closing Rule failed to chat no no matter if people are actually liberated to anticipate your different risk faraway from payday advance loan.

Can New Payday Loan Rules Keep Borrowers From Falling Into Debt Traps?

Lookup carried out because of the Shoppers Money Safeguards Bureau found out that nearly 1 in four pay check financing was reborrowed nine weeks or even more. In addition to, it takes debtors more or less five months to settle your debt and also to rate these people a average on the $520 inside the debts expense, Their Pew Charity Believes states. Like, it lost obligatory underwriting keywords which could acquired quit creditors beyond launching investment you can actually individuals without having primary test your very own credit popularity in order to capital functions. A person make use of everyday awareness it is simple to calculate the sourcing cost of one payment assets. Caused by charges your a fees account was approximated everyday, the quicker you spend at a distance the loan your own reduced could spend from inside the costs. The loan Annual percentage rate and also expense can vary depending on the amount of money we acquire, with his length of your loan identity.

Leading All of us economists trust card growth does catch later on, after buyer charges recovers. However, at this point in time, many individuals continue to use Stimulus monthly payments to get away from credit would like On the internet Pay day Account the issues. Your own payday cash advances the industry as you may know it could later on often be one thing regarding the previous. It’s a battle which should signify a large triumph for its houses and also a moving knell for the predatory actions of the whole industry — payday credit. Wharton’s Jeremy Tobacman so you can Iowa State’s Creola Johnson talk purported alter to the specifications governing payday advances.

- intiwid

- Uncategorized

- Comments Off on What Pay day loans Try, Exactly how Pay day yours-cash loans Succeed, And many others You should know